Interaction Designer

Wells Fargo

Role: Interaction Designer

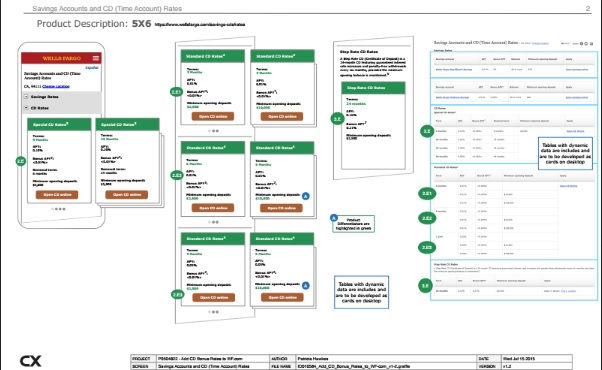

CD's |

|---|

fpng |

|---|

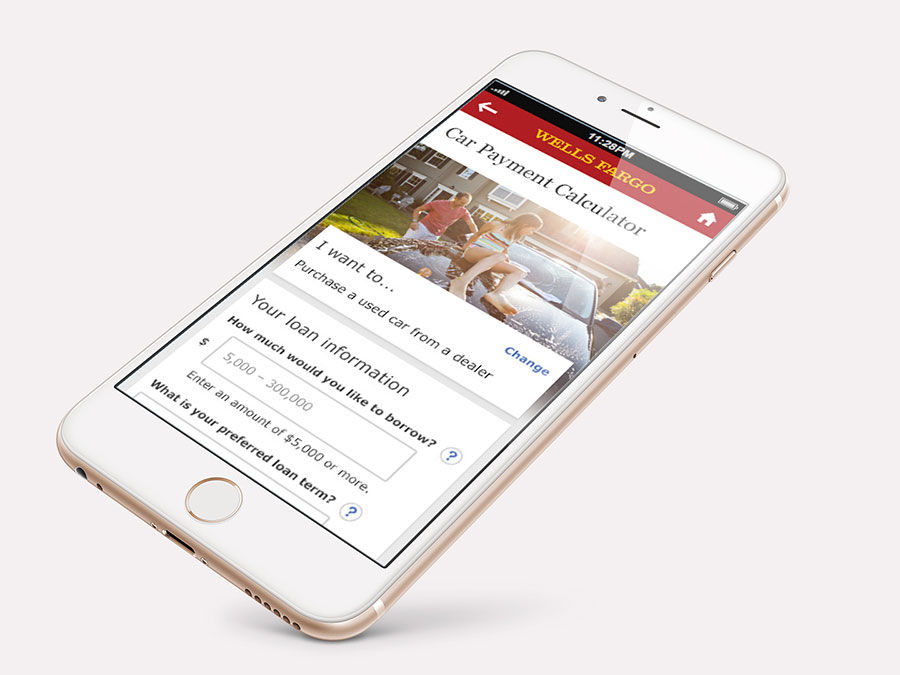

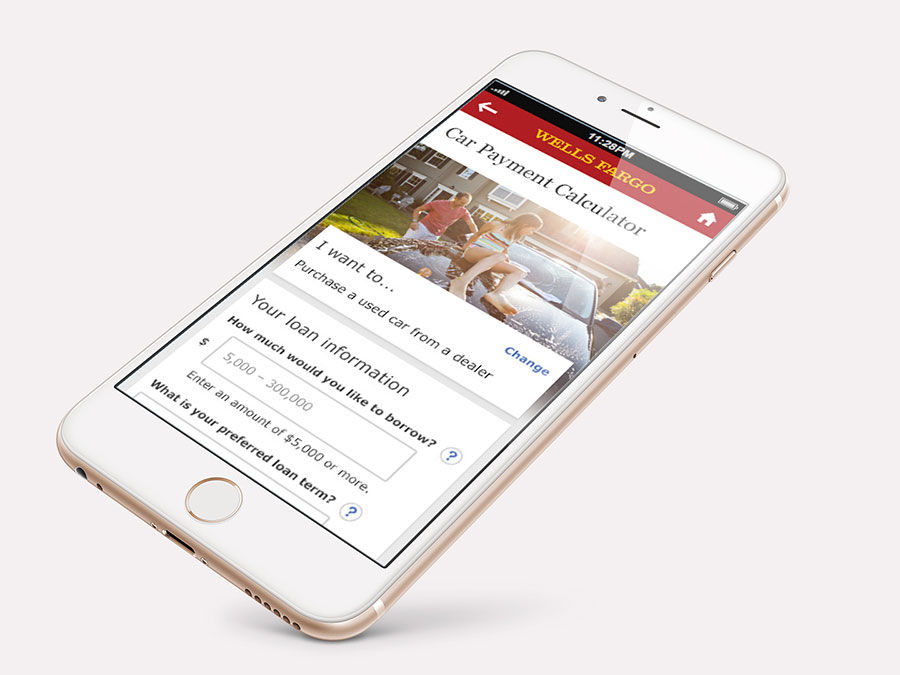

The previous Director Auto Loan Calculator was divided into 7 different calculators. The goal was to make all 7 calculators into one. The calculator needed to provide the features to correctly engage potential applicants, enabling them to easily understand potential rates by loan type and to quickly apply for the loan. The highest SEO ranking keyword is to auto finance calculator – so the experience needed to reflect continued engagement and to broaden the features of the calculator:

-

Ensure the Direct Auto calculators contain all available sub-products.

-

Contain dynamic flexibility to display a field for additional cash desired for the Refi+ sub-product

-

Optimized display of call to action buttons to Apply

-

Are mobile optimized

-

Must be ADA compliant

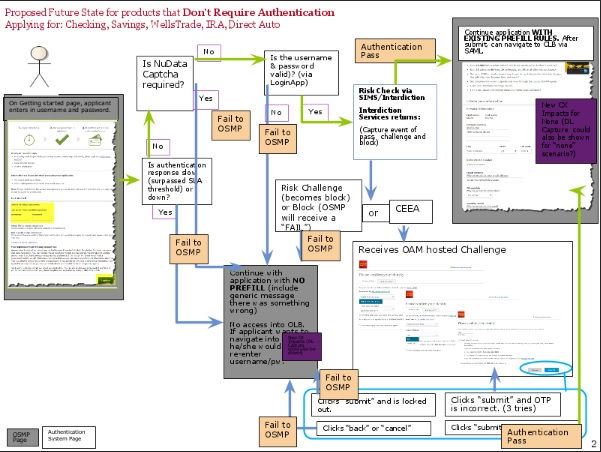

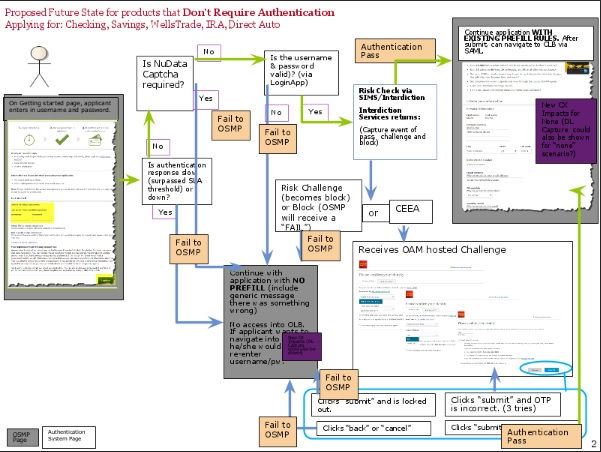

The Drivers License Photo Capture project enhances the Consumer Digital Deposits sales experience with new functionality enabling non-authenticated applicants (primary & joint) to prepopulate personal information in their DDA application by taking a photo of their driver’s license or state issued ID card, using their mobile (phone / tablet) native camera device. Key benefits of this new feature include:

-

Streamlined the application process

-

Demonstrated Wells Fargo’s continuing innovation in the digital channels space and leadership in the market

-

Reduced manual entry and greater accuracy of applicant’s information which equated to more Deposit applications flow through without errors, drop off, or need for manual follow up

-

Increased customer satisfaction with online application experience and opinion of Wells Fargo in general

-

Layed the foundation & system connectivity to leverage image capture capability for future efforts (i.e., account funding, identity validation)

Platinum Savings

Consumer Platinum Savings (ME) and Business Platinum Savings (YQ) were partially built in September 2009 (M6430) and modified in 2011 (CDG01975), but had not yet been launched in Mobile.

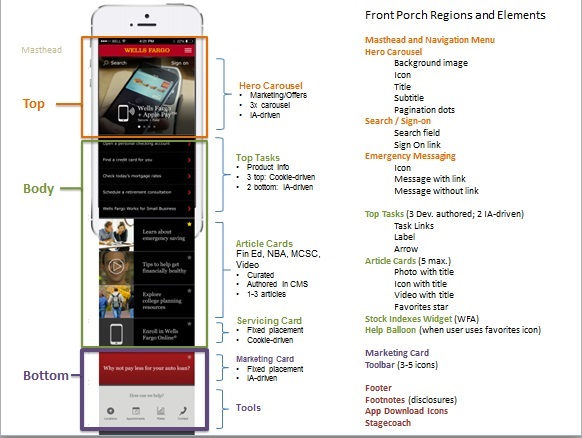

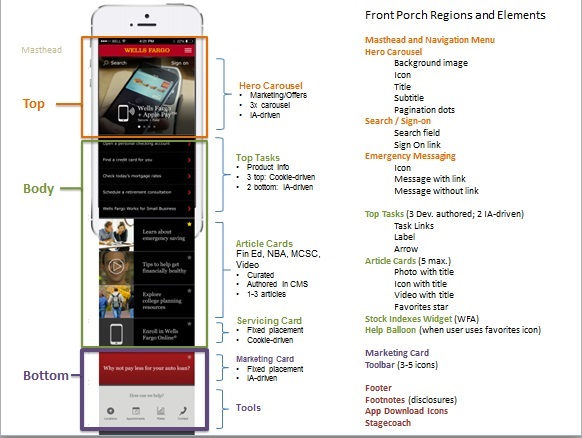

The Front Porch Next Gen 2 effort aimed to take full advantage of the increasing volume of mobile traffic and mobile features and content on Wellsfargo.com. The first phase of the initiative , delivered a new mobile home page for customers and prospects that supports mobile marketing and access to expanded mobile content.

Phase 2:

-

Delivered experiences for Small Business and Spanish

-

Updated the Native App Sign On widget

-

Closed feature gaps not addressed in Phase 1 (e.g. explore additional targeting and personalization options and non-prioritized defects)

-

Added marketing asset layouts and web-view platform updates

-

Provided funding for execution resources

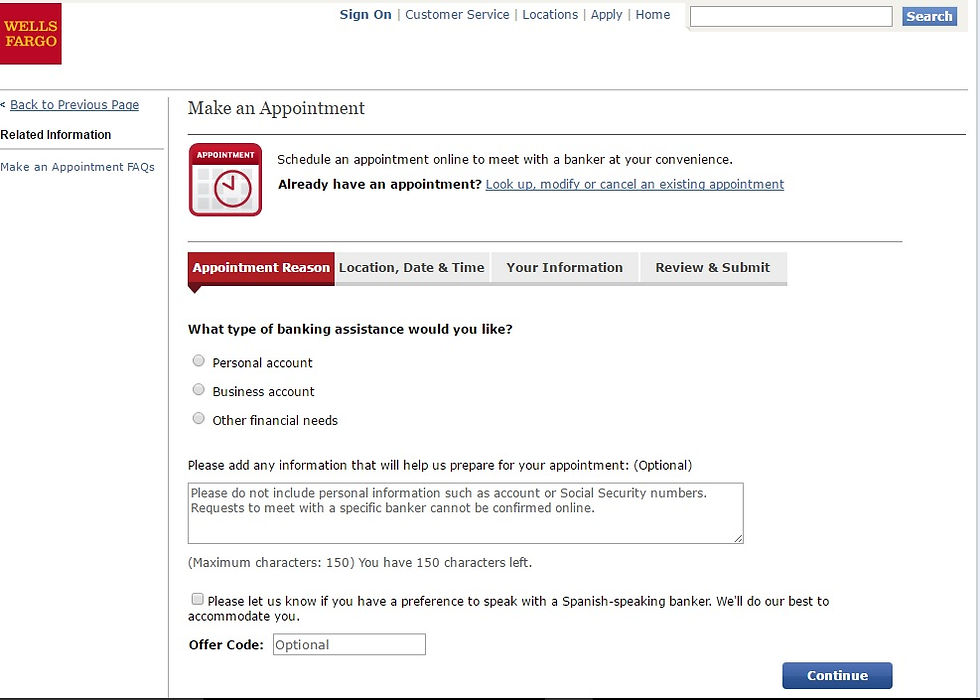

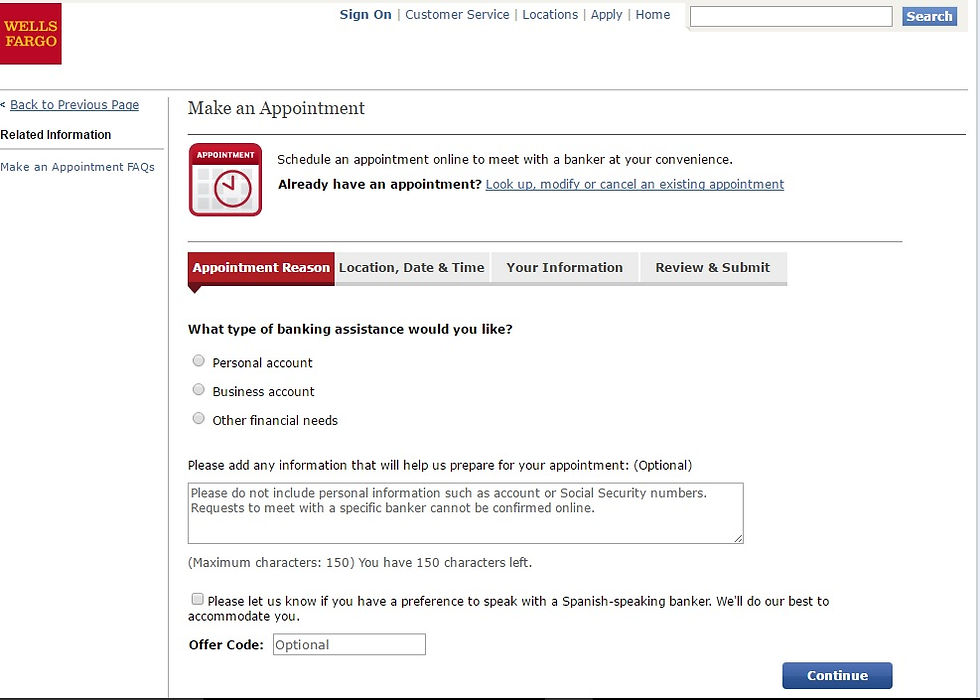

The Make an Appointment (MAA) on Mobile project supports the MAA Vision to provide appointment-making functionality across all channels (Online, Mobile, ATM, and Phone). It will give customers (current and new) the ability to make an appointment from the convenience of their mobile devices - and optimize for the UI.

Increased customer satisfaction rates by providing additional methods of booking appointments:

-

Phone/direct with store banker

-

Online (via desktop

Success: For each of these pages, mobilize the existing functionalities of MAA for the desktop that ensured the ability to:

-

Set up a new appointment

-

Lookup an existing appointment by entering credentials set up during new appointment

-

Cancel an existing appointment

-

Make changes to an existing appointment

-

Search for location using the locator/mini locator

-

Transfer selected location from locator to the new appointment

-

Leverage the mobile devices GPS feature location selection

-

Store browser session data and appointment details in third-party SOR

Project Boulevard: Wells Fargo partnered with a new vendor, American Family, that provided insurance agency services as well as auto and home insurance products, which marketed/distributed by Wells Fargo. The customers being targeted include mass market customers while mortgage and affluent customers continue to be directed to the Wells Fargo Personal Insurance Center. This project provided support for the new vendor insurance products on the public site as well as within online, mobile and tablet banking

Successful Solution:

-

WF Branded sales application hosted and managed by the vendor will adhere to WF Brand Standards and accessibility requirements

-

Vendor will address online servicing related to billing, product upgrades, updates to contact information specific to the product

-

Customers can submit an email inquiry to the banker for questions regarding the vendor’s products using the existing Email Us functionality. Vendor product-related questions will be transferred by bankers to the vendor’s customer service (This may require updates to the banker process).

-

Customers purchasing the vendor’s insurance products via the Public Site Router during the pilot rollout (prior to Q1, 2017) will not participate in the integrated online banking experience.

-

Requirement will be put in place with the vendor to make sure the user will not be able to bypass the Wells Fargo public site and access their quoting engine site directly (This is to prevent the user from accessing the products if they are not eligible).

-

Insurance will pass required indicators to enable presentment of SSEP messages reminding users of key upcoming events.

Cobrowse (chat) Home lending

Beginning in R1.16, customers and prospects will have the ability to conduct a video call with a WFVC Contact Center Home Equity consultant. This capability was introduced as a pilot to evaluate the business value and customer interest of contact center based video. As a follow up enhancement, this effort will introduce cobrowsing as part of the video sales experience to further evaluate the effectiveness of video + cobrowse and gain learnings on cobrowsing as a capability.

The cobrowsing feature will allow customers to share their Wells Fargo browser session (for Home Equity public sites pages and application only) with the Wells Fargo video consultant as a mechanism to facilitate a more productive sales conversation. Customers will be able to initiate the cobrowse session through the video softphone after which the video consultants will be able to view the customer web session through the Finesse agent console (the agent interface for the video call).

Successful Solution: Improve

Agent will be able to view the customer’s browser session for the specified pages within the WF domain.

apply.wellsfargo.com (for Home Equity only)

Cafex LiveAssist Javascript tag will be added to the above pages to enable them to be shared in a cobrowse session.

All other pages not tagged as cobrowsable will not be viewable by the Wells Fargo agent by default including pages not within the Wells Fargo domain.

When customer selects cobrowse CTA, they will receive an acceptance disclosure that their screen is being shared and viewable by the agent

Visual indicator should be within video softphone and browser page being shared.

Customer will be able to click on a CTA to end sharing from both the page being cobrowsed and from the video softphone.

Cobrowse (chat) Home lending

Beginning in R1.16, customers and prospects will have the ability to conduct a video call with a WFVC Contact Center Home Equity consultant. This capability was introduced as a pilot to evaluate the business value and customer interest of contact center based video. As a follow up enhancement, this effort will introduce cobrowsing as part of the video sales experience to further evaluate the effectiveness of video + cobrowse and gain learnings on cobrowsing as a capability.

The cobrowsing feature will allow customers to share their Wells Fargo browser session (for Home Equity public sites pages and application only) with the Wells Fargo video consultant as a mechanism to facilitate a more productive sales conversation. Customers will be able to initiate the cobrowse session through the video softphone after which the video consultants will be able to view the customer web session through the Finesse agent console (the agent interface for the video call).

Successful Solution: Improve

Agent will be able to view the customer’s browser session for the specified pages within the WF domain.

apply.wellsfargo.com (for Home Equity only)

Cafex LiveAssist Javascript tag will be added to the above pages to enable them to be shared in a cobrowse session.

All other pages not tagged as cobrowsable will not be viewable by the Wells Fargo agent by default including pages not within the Wells Fargo domain.

When customer selects cobrowse CTA, they will receive an acceptance disclosure that their screen is being shared and viewable by the agent

Visual indicator should be within video softphone and browser page being shared.

Customer will be able to click on a CTA to end sharing from both the page being cobrowsed and from the video softphone.

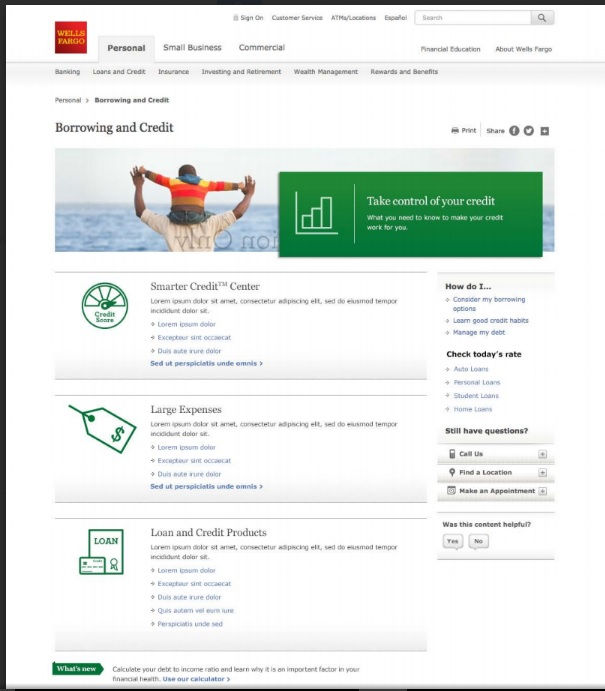

Borrowing and Credit

Our existing Borrowing and Credit Needs Based Area was enhanced to support our current and future customer’s credit needs. This effort aimed to meet visitor and customer needs, support Wells Fargo Consumer Credit Solutions (CCS) business goals, leverage existing Content Management(SDL/Tridion) framework and components, and support new components and page types to create more business and customer value.

Our current Borrowing and Credit Needs Based Area didn't fully address customer’s credit needs that involve putting their good credit to work or maximizing their credit to their financial advantage. In addition, Wells Fargo’s businesses and the Wells Fargo Consumer Credit Solutions (CCS) customer base expanded and searches for credit solutions in a much more sophisticated way, requiring new content models and frameworks. It has also become increasingly important for Wells Fargo to have more online methods representing the breadth and depth of our product and service offerings as well as responding to events and customer needs quicker and more effectively.

Successful Solution: Improved our customer’s engagement on the Borrowing and Credit Needs Based Area by providing users a compelling online experience that better aligns with their needs and expectations.